As the pandemic continues to create unprecedented economic uncertainty, the Australian Tax Office (ATO) is pulling out all the stops to assist, including the introduction of the COVID-19 Superannuation Early Release Scheme or simply, the Early Release Initiative (ERI).

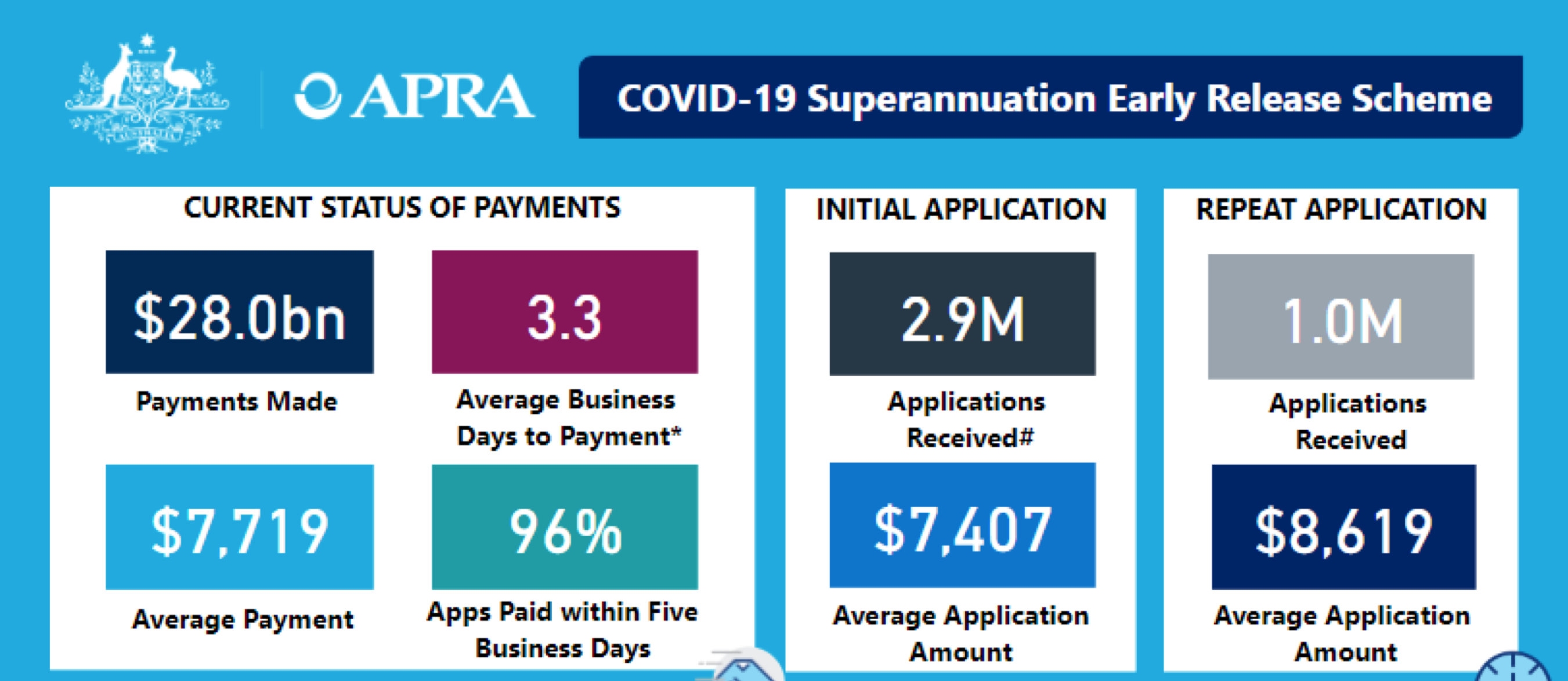

ERI is designed specifically to enable Australians experiencing financial hardship to withdraw funds from their own superannuation accounts, as quickly as possible. Statistics in the below graphic show the initiative's high uptake -- 2.9 million applications received, and payments to-date exceeding $28 billion.

Data published by The Australian Prudential Regulation Authority (APRA) on the COVID-19 Superannuation Early Release Scheme, from inception of the Scheme to 27 July 2020. For full details, visit www.apra.gov.au

With strong uptake of the initiative comes additional workload demands on each super fund.

APRA has issued the super fund industry with stringent guidelines, to embed measures to monitor processing capacity and track payout delays for each super fund via mandatory weekly, monthly, and quarterly reports.

Applications need to be processed as a matter of urgency. The tight timelines and processing of requirements to pay eligible members are proving complex, time-consuming and a drain on resources.

Regulators have mandated super funds to provide a summary of ERI payments. These reports include details on the members circumstances such as insurance status, account closure, claims and a list of other information. Collecting such varied and diverse information is often quite complex, often sourced from several different systems.

Adding to the complexity, there has been multiple amendments to the initial reporting requirements, causing a mad scramble to add the new data requirements going forward, remove data which is no longer required and even, apply the changes to previous reports and re-submit with the amended data requirements.

There is no hiding from the fact that super funds which have invested time and effort to centralise their various source systems into a single unified layer are finding the burden to report on ERI far less.

Super funds we've worked with on their data transformation are seeing the results of their data unification efforts. With fully automated, one-click reporting, wrapped in tight security and governance, these super funds are producing reports of the highest quality and trust.

Key considerations when looking for an automated reporting solution:

The foundation of unified data, prepared for the purposes of reporting and analysis, in combination with a very clear understanding of ATO and APRA regulatory requirements, is crucial.

Don't risk error. Assure compliance, today.

Talk with Tridant subject matter experts to understand how to empower your super fund with fully automated, one-click reporting, wrapped in tight security and governance.

A special thank you to Zac Anstee for his contributions to this article.

Adwait Dhole | Michelle Susay | Zac Anstee

Copyright © Tridant Pty Ltd.