Rolling forecasting supports decision-making by incorporating the most up-to-date information in the planning model, whether this be the latest financial monthly results, or updated market and sales assumptions.

For the week commencing March 23 2020, it was reported that "customers using Workday Adaptive Planning processed up to 30 times more forecasts and scenarios than in a typical week. That means companies stepped up planning and replanning as conditions rapidly shifted. Since the pandemic's beginning, Workday has seen an overall average increase of 15 times the amount of modeling and re-calibrating as organisations attempt to make sense of the ripple effects of the global pandemic on their businesses."

Advance from static annual plans and budgets to a more active planning process.

An annual budget is a static plan, whereby the next 12 months are planned based only on the information available at that point in time. Actual results for the business are measured against the budget, with no consideration for changes that have occurred since the budget was developed. There is also no view of the future business position, or the potential challenges and opportunities the business will face.

A rolling forecast may use the annual budget as a starting point but will provide updates with monthly actual results as the forecast moves forward on a continual 12-24 month basis depending on the organisation’s planning requirements.

As the forecast is updated with current actual data, there is opportunity to review and update the assumptions made to calculate the forecast. By doing this, the forecast will continually provide up to date information and real-time insights, enabling the business to make the decisions that will accommodate these changes.

Rolling forecasts drive accuracy, agility and driver-based decision making.

No more spreadsheets.

Planning tools are required for operational efficiencies, more effective use of data and reliable connectivity between stakeholders.

Empower your finance team to move away from maintaining multiple workbooks and spreadsheets to create budgets and forecasts, to an assumption and driver-based tool.

The advantages of using Workday Adaptive Planning over spreadsheets are:

- Time: Workday Adaptive Planning allows for assumptions and formulas to be automatically updated centrally, and with integration to other information systems, such as the GL, to allow for automatic uploads with minimal data entry.

- Accuracy: With data uploaded from the source and metadata managed centrally, there is minimal need for manual entry. As the data is held centrally in one system, there is no issue with out-of-date spreadsheets or siloed data held in areas that others have no access to. Information remains updated and accurate, as well as easily accessible to authorised users.

- Timeliness: As data is saved or formulas updated, the updates are applied to all levels in the structure or rolling forecast model. Updated insights are available immediately with no requirement from the finance team to consolidate multiple worksheets and workbooks using spreadsheets.

- Agility: Workday Adaptive Planning allows for the review of results or forecasts in real time, and the ability to adjust the model as required. The effect of these changes can be seen immediately.

Efficiency gains can be seen in the reduced resources needed to produce budgets, management reporting and rolling forecasts.

Responding quickly with rolling forecasts.

Recently, Tridant was appointed to support a large finance client in Asia Pacific facing constraints in their data collation and scenario modelling. To improve and accelerate evidence-based decision making by executives, we moved them from spreadsheet-based planning to Workday Adaptive Planning.

The outcomes achieved include:

- The business no longer required 70 workbooks. Each had averaged 5 worksheets per workbook.

- The annual budget creation process decreased from 16 weeks to 6-8 weeks and allowed for the completion of budget submissions to be completely automated. The time-savings gained was used by finance leaders and stakeholders to do more analysis and strategic planning.

- Their forecasts increased from quarterly to monthly forecasts. This was enabled by the ability to use rolling forecasts in Workday Adaptive Planning.

- By running rolling forecasts and no longer relying on siloed spreadsheets, the forecasting process was reduced from 2 weeks to 4 days.

The business was able to allocate resources away from time-consuming manual tasks to strategic analysis and planning, and improve short-term decision making while measuring and monitoring outcomes against strategic direction.

Critical considerations when moving to rolling forecasts:

When moving to a rolling forecast it is important to understand the changes required within the business. Initially, there may be more time and cost required while developing the forecast model, as well as training for staff and changes to processes.

- Consider the business objective for creating a rolling forecast. The move to a rolling forecast needs to be a dynamic change; from the necessary exercise of completing a budget, to adding value through gaining insight into what is driving the business and being able to make informed decisions in real time. Understand the KPIs that can be achieved from using the forecast.

- For a rolling forecast to be effective, the value drivers and assumptions within the business need to be established. These drivers may relate to predicted sales, or the required cost of production. Assumptions may relate to personnel costs, such as taxes, leave and benefits, or other items such as CPI, interest rates, timing for revenue or expenses.

- Look at the level of detail for inclusion in the forecast. The budget may be the starting point for a rolling forecast, but many items in the budget may not need to be updated monthly. This may be due to materiality, contracted amounts that do not change, or they may not be considered as part of the KPIs or drivers to be measured.

- Understand the contributors, stakeholders and audience for the forecast. Ensure all interested parties are involved in the development of the forecast process and development. This includes defining the scope of the forecast with stakeholders to ensure the model meets defined objectives.

- Look at available data sources within the business, not just financial data. Validate where value driver data is available and aim to integrate this into Workday Adaptive Planning. Also, look at relevant information that can be added to reports and dashboards to provide insight to the financial data.

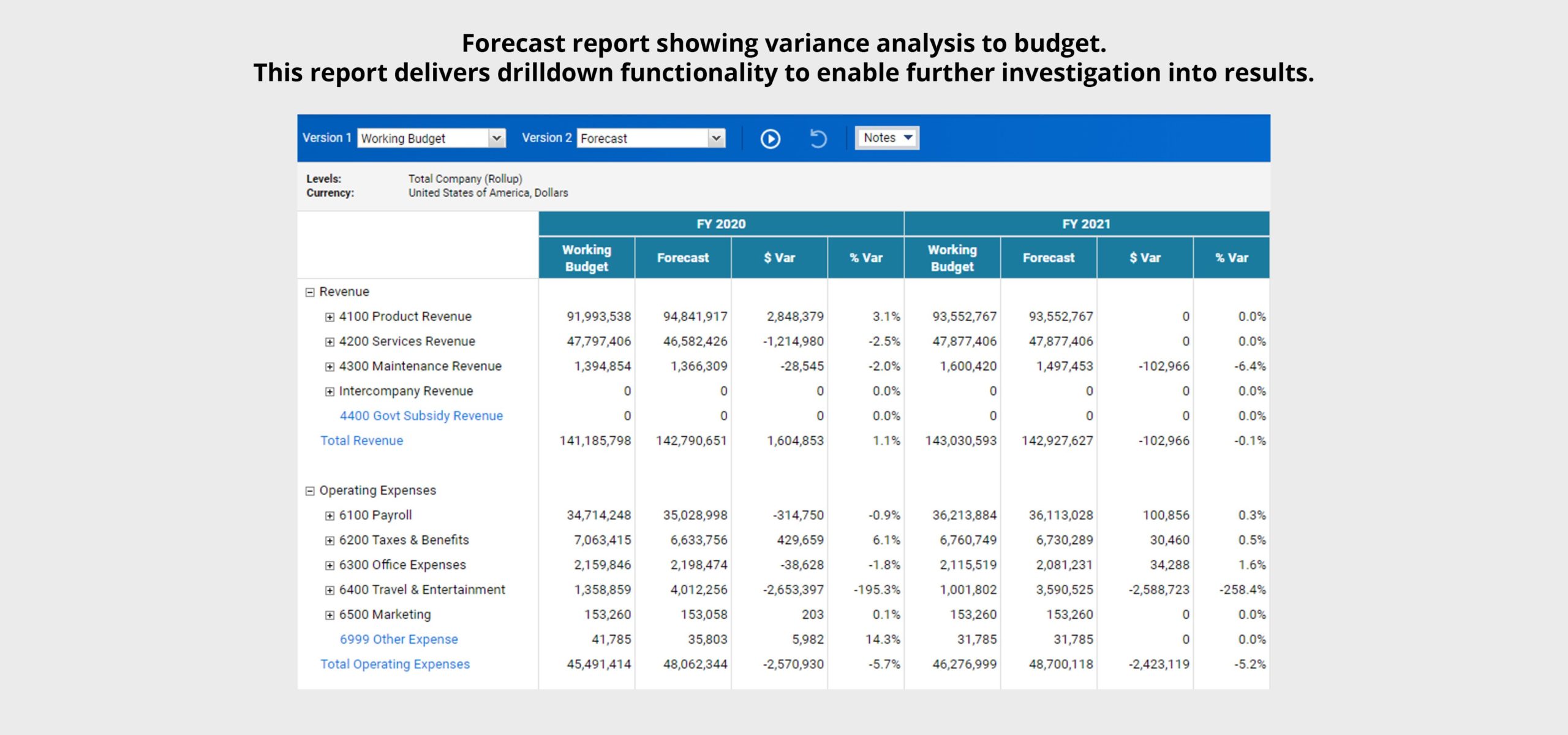

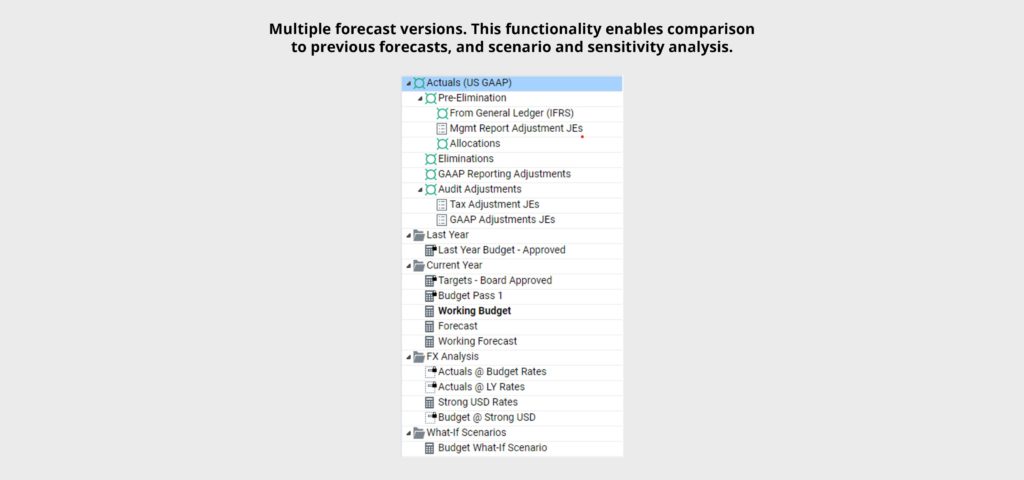

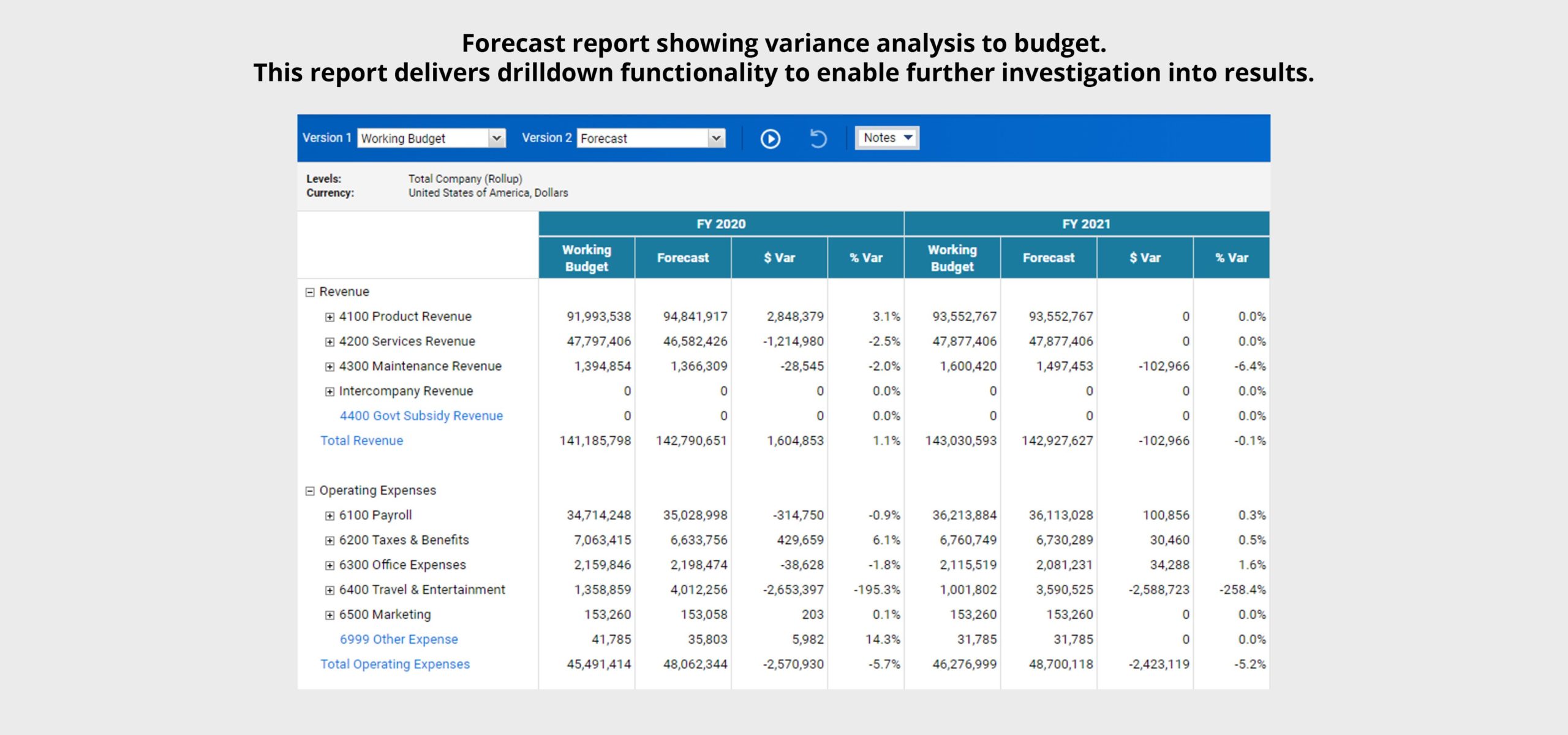

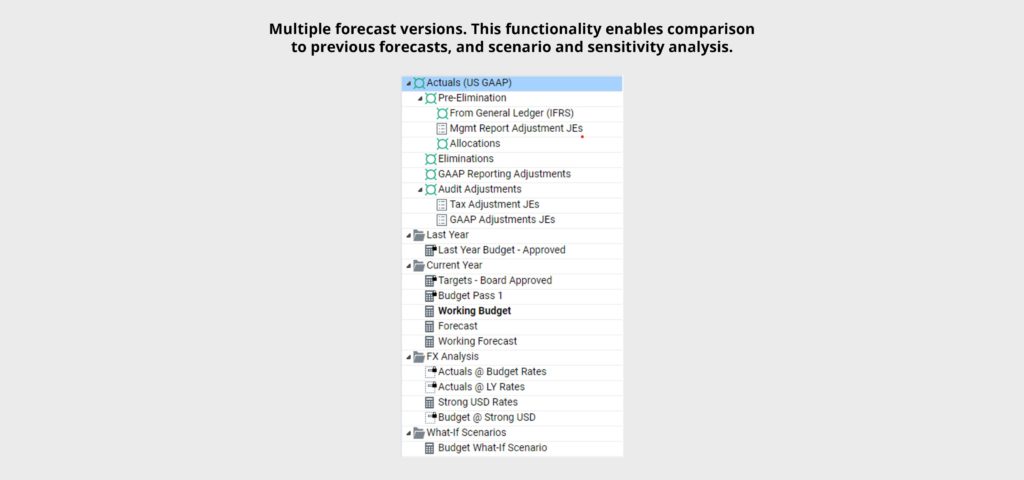

- Create multiple versions for the forecasts. Workday Adaptive Planning enables each forecast to be kept as a separate version, allowing comparisons for previous forecasts to current forecast or monthly actuals. Having multiple versions also enables organisations to create different scenarios and sensitivity analysis for the forecast.

In summary, the overall key benefits of using rolling forecasts include:

- saving time and reducing complexity for the business

- increasing business agility

- more accurate and timely information and data insights that support decision-making to build better business resilience, and

- quickly getting information to the areas of the business where it is needed.

Automated processes, dynamic planning, better business.

At Tridant, we specialise in finance transformation. We support finance and workforce clients in mid-to-large companies across industries to improve their planning and modelling skills and grow business agility – with company-wide collaboration to plan, model, budget, and forecast better.

Speak with Tridant to empower your business to quickly adjust actions in the short-term, re-allocate resources and proactively respond to emerging trends.

Robin Webber | Michelle Susay

1. Association for Finance Professionals, AFP Online, COVID-19: FP&A Professionals Expect a Painful, Slow Recovery