Many businesses are moving to replace their static annual budgets with rolling forecasts. Rolling forecasts makes businesses more agile by delivering greater levels of transparency around emerging risks and opportunities for the organisation.

See what's happening in real time. Respond quickly with rolling forecasts.

A rolling forecast differs to the annual budget in that it is continually updated with each management reporting period, usually monthly, and rolls forward as each set of actuals is added to the forecast.

In the digitally-led workplace, data collation, rapid scenarios, and evidence-based decisions are non-negotiable critical capabilities. These are almost impossible to achieve with annual, spreadsheet-based forecasting.

Due to shifting conditions and uncertainty, the value of the annual budget is in question. Besides being a time-consuming and costly internal process, the static approach of an annual budget has inherent limitations that impede flexible and agile business planning.

A rolling forecast empowers organisations to continuously plan, or forecast, over a pre-determined period. For example, if your company creates an annual plan, a rolling forecast will re-forecast the next 12 months, every month. This provides the transparency that organisations need to adapt to rapid market changes.

In addition to helping businesses build resilience through agile forecasting, rolling forecasts help organisations more effectively plan and allocate resources to optimise business operations and reduce operating costs.

The first thing to consider with a rolling forecast is the length of time it should cover. The usual timespan is 12-24 months. Rolling forecasts do not replace budgets or strategic plans but provide a continual analysis of the business position that allows for operational adjustments based on changes to market assumptions and key business indicators.

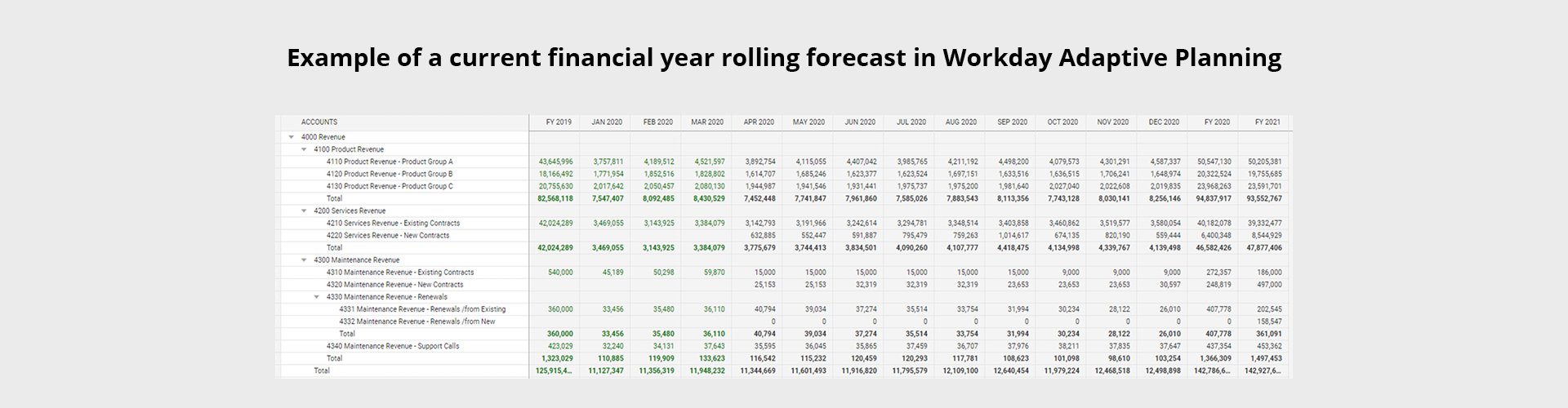

Rolling forecasts can either be used for the current financial year only or can incorporate future financial years for forward planning.

In the current financial year model, rolling forecasts are set for 12 months and, as each month is rolled over, the forecast only covers the remaining months of that year. An example is shown below using Workday Adaptive Planning, where the values in green are the actuals and the black are forecast.

Unlike a current financial year forecast, a continual rolling forecast includes forecasting into the following financial year for a defined number of months, which lets finance teams incorporate longer-term planning. [MS2]

The most common way to use a rolling forecast is to combine the current financial year with continual rolling forecasts.

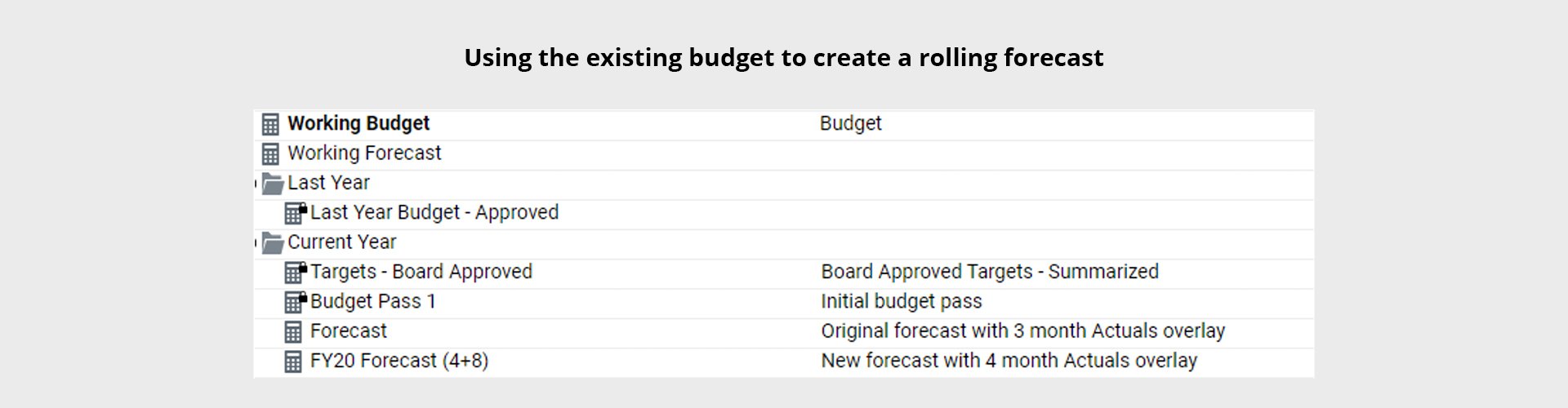

When building a rolling forecast in Workday Adaptive Planning, start with the existing budget. This includes the structures, accounts, and formulas required for the forecast. To create a forecast from the existing budget, use the Versions window in Model Management to make a copy.

While the structure and accounts will remain the same from the budget to forecast, a full review of the formulas is needed as there will be time constraints set into the budget.

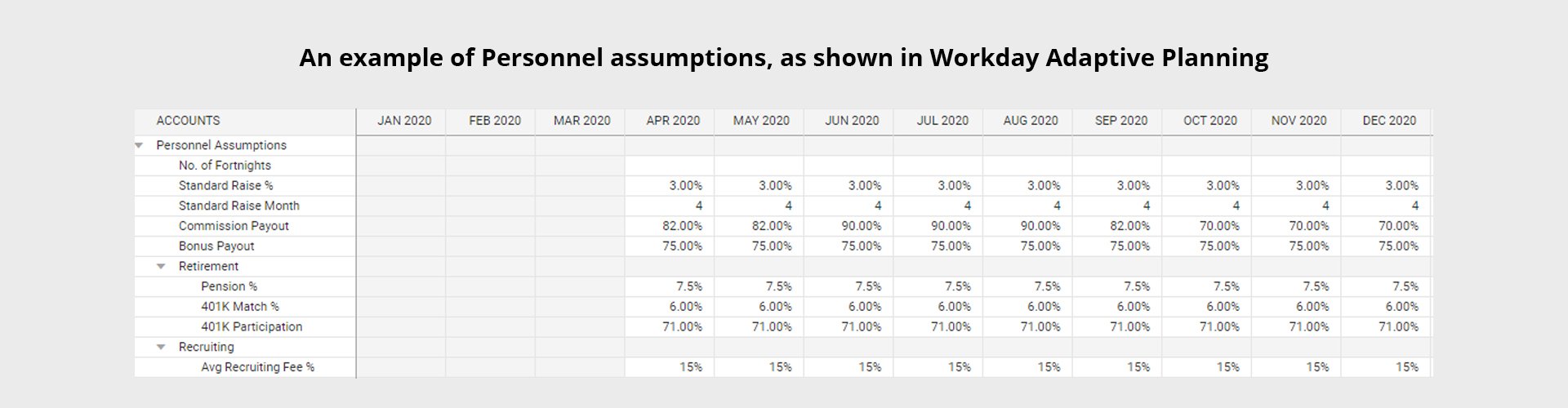

Assumptions and drivers from the budget will need to be reviewed to ensure these meet requirements for the extended timeframes to be used in the forecast.

Particular attention should be paid to the Personnel assumptions regarding taxes and oncosts. Period measurements, such as working days in the month and public holidays, also need to be calculated.

Consider additional assumptions and drivers that were not required for the budget but may be valuable for the forecast.

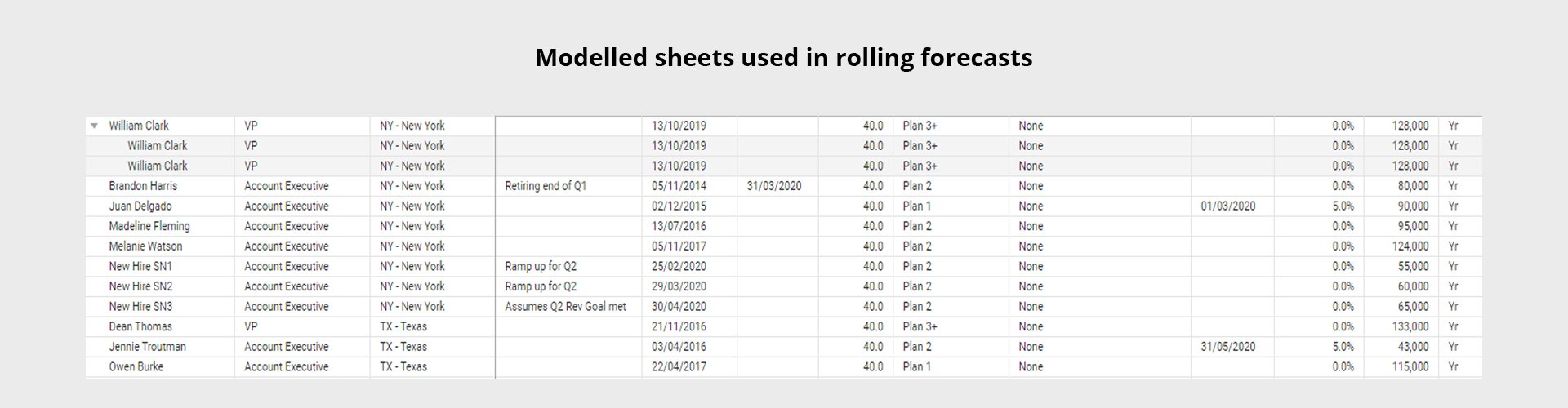

Identify modelled sheets to be used in the rolling forecast and where the source data for these sheets is located.

Modelled sheets are static and will need to be regularly updated for accurate forecasting.

If this data is to be updated monthly, the Adaptive Planning integration loaders may help to automate this process.

One of the main modelled sheets that businesses use is the Personnel sheet. This requires regular updating and is an example of where an integration loader should be used, along with customer relationship management (CRM) data for calculating revenue/sales.

Maintaining rolling forecast versions is important to ensure accuracy and for historical reviews. Best practice is to make a copy of the current forecast and roll this over to the next forecast version. This means that any adjustments made in the current forecast are carried over to the new version.

Maintain each forecast as a unique version so that comparisons can be made between versions. This is crucial because data, such as personnel information, may be overwritten with each new version of the forecast.

Having multiple versions of the forecast enables finance teams to conduct what-if analysis for more effective scenario planning. Dashboards can then be created to show the impact of changes in real time, without affecting the current forecast.

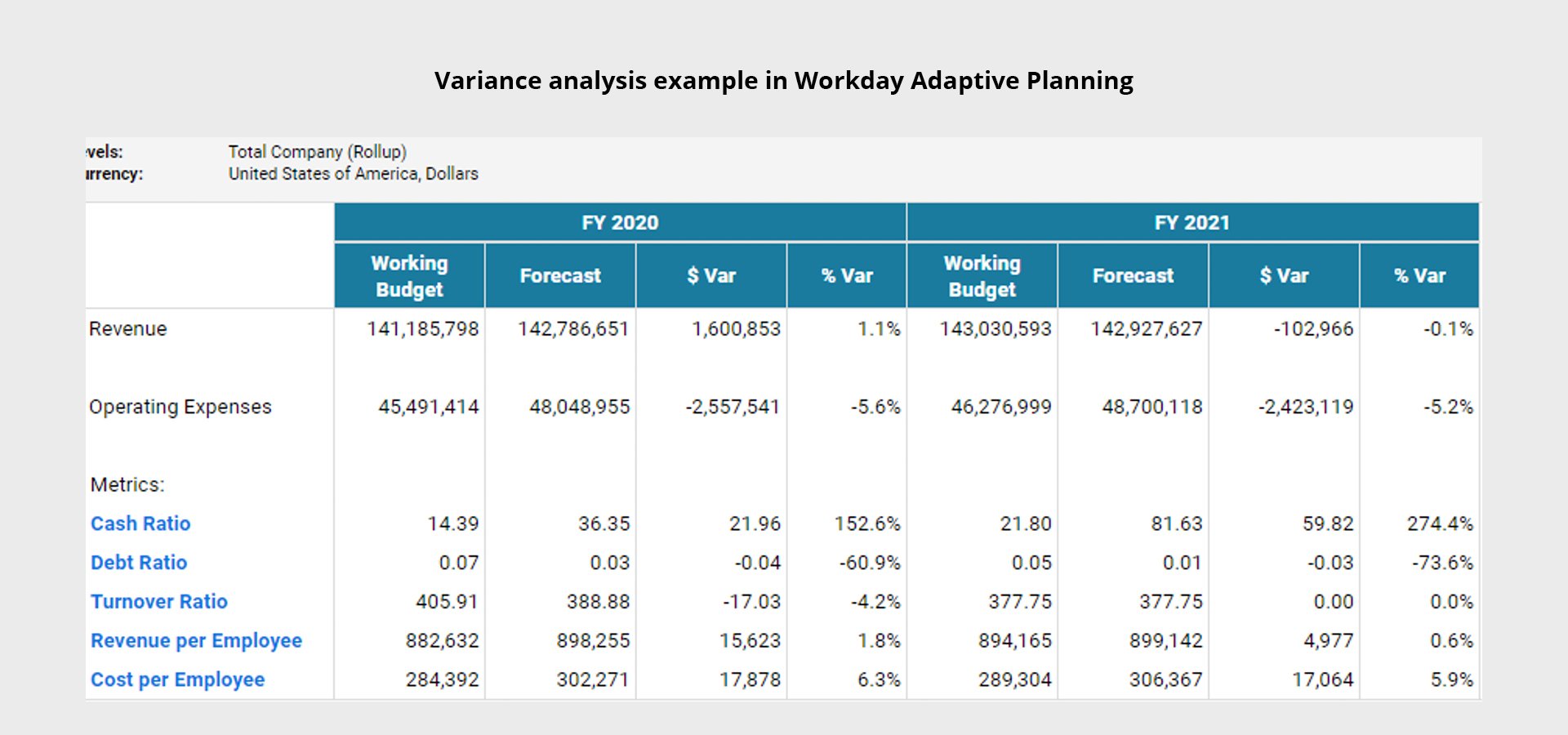

Rolling forecasts enable businesses to report forecast KPIs against various versions. For example, reports can be designed to show the current forecast variances against previous year actuals, previous forecasts, and budgets.

These are some of the important factors to consider when converting the annual budget to a rolling forecast in Workday Adaptive Planning. Depending on an organisation’s needs and planning models, there may be additional requirements to consider. Specific organisational needs must be considered when building a rolling forecast model.

To ensure optimal return on investment, the forecasting model must include data, technology, process design, and people. The transition to rolling forecasts is not a typical IT project, so technology capability and implementation should not lead the transition. Instead, the transition to rolling forecasts requires a considered and consolidated approach across the executive leadership, finance, and IT teams. This approach will drive improved organisational agility.

Plan more frequently, anticipate changes, and decisively respond to the changing conditions, demand, and competitive threats. Request a discovery session to learn how Tridant is helping finance stakeholders to identify emerging opportunities and accelerate top-line growth.

Download this FREE eGuide to take the first step toward moving to a dynamic planning approach that enables your business to quickly serve emerging priorities and economic objectives.

Copyright © Tridant Pty Ltd.